What does it cost to have a financial planner?

Why you need a financial planner

Whether you’re living paycheck-to-paycheck with little retirement savings, a financially savvy self-investor, or are somewhere in the middle; a financial planner could be beneficial for you. A planner can be especially helpful during a major life change. Getting married, starting a family, buying or selling a home, inheriting money or changing jobs are just some of the times when a planner can help you. You don’t necessarily need to wait until a major life event to get helpful advice. A planner can also help build a financial plan to meet goals such as saving for college education, building an investment strategy, starting a business or planning for retirement. For the DIY investors, a planner can give you a non-emotional view on your investments to help with diversification and tax strategies that can put you in an even stronger financial position.Understanding Financial Advisor Fee Structures

In the financial industry there are a few different ways a planner charges a fee for their services. The fee structure may be defined by the planner’s preference or what services they offer. Here are four of the main fee structures that you’ll see most often:1) Percentage of assets under management:

A planner charges a percentage of the client’s total assets that they oversee. This percentage may vary based on the amount of assets under management. This is typically the way we manage our client’s assets at Sgroi Financial. We feel this way is beneficial to our clients because we have an incentive to grow the funds. As the client sees an increase in their account, we see an increase as well.2) Hourly charges:

This is a set hourly rate that doesn’t change based on a client’s asset level. This is typically for special projects or consulting.3) Fixed fees:

This would be a set fee for a certain type of service. You’d know what’s included ahead of time but you wouldn’t receive ongoing management. An example of this would be the creation of a financial plan that you would carry out yourself.4) Commissions:

A planner would be paid through commissions on what they sell to you. They would receive compensation when a trade or purchase is made.In addition, it is important to know and understand how a planner will be paid.

1) Fee-only:

A fee-only planner will not earn any commissions from investments. They only earn money from fees paid by their clients. This provides the client insurance that the planner faces the fewest conflicts of interest when offering advice.2) Fee-based:

A fee-based planner charges a fee while receiving commissions from the investments chosen.3) Commission-only:

A planner earns income from commissions of the investments bought and sold for their clients.How Much Do Financial Advisor Fees Typically Cost?

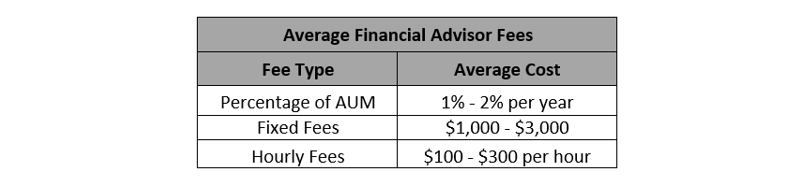

Much like the fee structures, the costs of a financial planner can vary. And as the landscape of the business has changed, so have we. Once a more commission driven industry, today we are seeing more firms manage with a fee-only or fee-based structure. According to a 2017 study the average financial advisor cost is 1.02% of Asset Under Management for a $1 million account. Based on that study, here are the average fees:

WEEKLY SEGMENT ON WYRK

You can catch our weekly Plan.Protect.Invest. segment live on WYRK 106.5FM at 7:20am every Wednesday. Each week we will have a Sgroi Financial planner on with Clay Moden and the WYRK morning show to discuss financial topics to educate and help their listeners. Since 1971, Sgroi Financial has proudly served Buffalo, NY and the Western New York community from our West Seneca location.Address

Phone

Check out the background of our investment professionals on: BrokerCheck

Securities offered through Cadaret, Grant & Co., Inc., member FINRA/SIPC. Advisory services offered through Sgroi Wealth Advisory Group LLC, an SEC Registered Investment Advisor. Sgroi Wealth Advisory Group LLC, Sgroi Financial LLC, and Cadaret, Grant & Co., Inc. are separate entities.

Due to various state regulations and registration requirements concerning the dissemination of information regarding investment products and services, we are currently required to limit access of the following pages to individuals residing in states where we are currently registered.

We are registered to sell Securities in the following states: AZ, CA, CO, CT, FL, GA, IL, KY, MA, MD, MI, MO, NC, NJ, NV, NY, OH, PA, RI, SC, TN, TX, UT, VA, and WA

Client Login